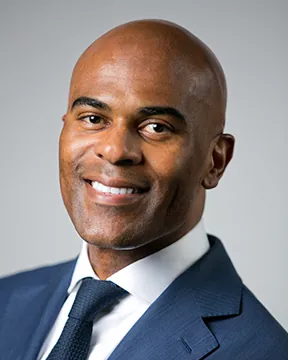

Geoffrey K. Alexander is CEO of R.M. Davis in Portland, Maine. Prior to assuming the role of CEO, Alexander served as president of the firm for seven years. He has also worked directly with high net worth and ultra-high net worth clients at R.M. Davis for more than 25 years. Alexander has served on numerous nonprofit boards at both the state and local levels. He has been very actively involved with the IAA, including serving as the current chair of the Board of Governors, as well as participating in numerous events and advocating for the industry on Capitol Hill. Alexander earned an MBA from Boston University and a B.A. from Colby College.

Amber Allen is counsel in Eversheds Sutherland’s Investment Services & Products practice, where she advises leading financial firms on complex regulatory and compliance matters. Her experience spans SEC examinations, portfolio management, trading, advertising, private fund formation, mergers and acquisitions, and cybersecurity and data privacy. Previously, Amber served as general counsel and executive vice president at Fairview, LLC. She brings deep expertise in governance and risk management, with experience in founding a legal department and implemented enterprise-wide policies on cybersecurity, data protection, and business continuity. Allen holds a B.S. in Business Administration – Finance from North Carolina State University and a J.D. from Elon University School of Law. She is a Certified Information Privacy Professional.

Karen L. Barr is president and chief executive officer of the IAA. Before assuming the role of president and CEO in 2014, she served as the IAA’s general counsel for 17 years, with responsibility for the wide range of legal and regulatory matters affecting the investment adviser industry. Prior to joining the IAA, Barr was in private practice at Wilmer, Cutler & Pickering (now WilmerHale), where she represented clients in SEC investigations, securities class action litigation, internal corporate investigations, and securities regulatory matters. She received her B.A. from the University of Pennsylvania and her J.D. from the University of Michigan Law School.

Davie Baccei is a partner and the chief compliance officer at Jordan Park. She is responsible for the firm’s compliance program, covering investment advisory, family office services, an investment platform encompassing separately managed accounts and private funds, as well as an affiliated broker-dealer entity. Prior to Jordan Park, she held numerous roles within compliance at Goldman Sachs for over 20 years, primarily covering private wealth management during a period of significant regulatory and business changes. She first joined Goldman Sachs in 1993 as an analyst and rejoined the firm in 1997 as an associate. She was promoted to vice president in 2000 and named managing director in 2014. Baccei earned a B.A. in English Literature from the University of Tulsa.

David P. Bartels is a partner in Dechert’s financial services group. As former deputy chief counsel of the SEC Division of Investment Management, he has extensive experience with regulatory issues faced by asset managers and both registered and unregistered funds. He also managed guidance IM provided to the Divisions of Enforcement and Examinations and provided technical assistance on proposed legislation. Prior to joining the SEC, he was an associate in the corporate practice of an international law firm. He earned his B.A. from the State University of New York at Buffalo and his J.D. from Yale Law School. He is admitted to the Bar in the District of Columbia and New York.

Gail C. Bernstein general counsel and head of public policy for the IAA. She joined the IAA in 2017 from the law firm of WilmerHale in Washington, DC, where she had been a special counsel and before that a partner in the Securities Department. While in private practice, Bernstein counseled clients on all aspects of financial and securities regulation. Bernstein earned her B.A. from the Hebrew University of Jerusalem and her law degree from Harvard Law School in 1988. After law school, Bernstein clerked for the Honorable Douglas P. Woodlock of the U.S. District Court for the District of Massachusetts.

Sarah A. Bessin is senior associate general counsel, U.S. regulatory affairs and investment management, at Franklin Templeton. Previously, she was deputy general counsel at the Investment Company Institute. Bessin has also served in multiple roles at the SEC, including as assistant director of the Office of Investment Adviser Regulation in the Division of Investment Management; assistant chief counsel in the Division of Enforcement; and special counsel in the Division of Investment Management’s Office of Chief Counsel. She also spent more than five years in private practice at Shearman & Sterling LLP (now A&O Shearman), advising financial services clients on a wide variety of regulatory, transactional, and compliance matters. Bessin received her B.A. from the University of Michigan and her J.D., cum laude, from the University of Michigan Law School.

Monique S. Botkin is associate general counsel of the IAA. Prior to joining the IAA in 2004, she was an associate in the financial services groups at Dechert LLP in Newport Beach, California, and Alston & Bird LLP in Washington, DC. While in private practice, Botkin represented investment advisers, registered investment companies, private funds, and broker-dealers in corporate, securities and investment management matters. Botkin also served as an attorney in the SEC’s Division of Investment Management disclosure review office from 2013 to 2014. She earned her B.A. in government and politics from the University of Maryland at College Park and her J.D., cum laude, from Southwestern University School of Law in Los Angeles, where she was an editor of the Law Review.

Nevis Bregasi is senior vice president and deputy general counsel at MFS Investment Management, where she leads the Legal Department’s Global Advisory team responsible for providing legal and regulatory support for advisory work globally as well as for retail and institutional distribution. In addition, her team covers litigation, regulatory and employment work and also provides legal support for investment and investment operations. Nevis acts as vice-chair of the SIFMA Asset Management Group’s Steering Committee. She joined MFS in September 2007 after working in the Bankruptcy and Commercial Law Department at WilmerHale’s Boston office and in the International Markets and Bankruptcy Departments at Allen & Overy’s New York office. She received her J.D. from Harvard Law School.

Justin L. Browder is a partner at Simpson Thacher & Bartlett LLP, specializing in registered funds, asset management regulatory, and enforcement matters. He counsels investment advisers, funds and broker-dealers on federal securities laws, with a focus on the Advisers Act and the Investment Company Act. Browder advises private fund managers and sponsors of wealth management and separately managed account programs on operational, transactional and adversarial matters. He also represents clients in SEC examinations and enforcement proceedings. A recognized practitioner in digital assets, Browder advises asset managers and exchange platforms on compliance and operational matters. In addition, he represents financial sponsors and strategic investors in mergers, acquisitions, and spin-outs of asset management businesses and advises alternative asset managers on fund formation.

Chris Carlson is a senior counsel in the SEC Division of Investment Management’s Chief Counsel’s Office (CCO). Before Carlson joined CCO in September 2021, he was counsel in Seward & Kissel LLP’s investment management group and Thompson Hine LLP’s investment management practice. He started his career as an associate in Dechert LLP’s financial services group in 2008, moved in-house starting in 2014 as assistant general counsel at American Realty Capital, and later served as associate general counsel and vice president at Goldman Sachs Asset Management. He earned his B.A. from the Catholic University of America and his J.D from The George Washington University Law School.

Charu A. Chandrasekhar is a litigation partner in Debevoise & Plimpton LLP’s New York office and a member of the firm’s White Collar & Regulatory Defense and Data Strategy & Security Groups. She has substantial experience in counseling clients on the SEC’s cybersecurity regulations, recordkeeping requirements, and artificial intelligence examinations and enforcement. Previously, Chandrasekhar served as an assistant regional director in the SEC’s Division of Enforcement and as the founding chief of the Division’s Retail Strategy Task Force. She also served in the Division of Enforcement’s Market Abuse Unit and clerked for the Honorable Sonia Sotomayor when she sat on the U.S. Court of Appeals for the Second Circuit.

Cissie Citardi, partner and general counsel of William Blair, oversees legal, compliance, enterprise risk, information security, and internal audit. She serves on the firm’s executive committee and the boards of the William Blair Funds and William Blair SICAV. Before joining the firm in 2020, she was general counsel of PineBridge Investments and previously worked at Silver Point Capital and Shearman & Sterling. Originally from Australia, she began her career in the Federal Court of Australia and at Herbert Smith Freehills. Cissie is active in industry forums, serves on the Special Olympics Illinois audit committee, and holds a BSc (Hons) and LLB (Hons) from the University of Sydney.

Johanna Collins-Wood is the general counsel and head of compliance, U.S. asset management, at Bitwise Asset Management and the chief compliance officer of Bitwise Investment Manager, an SEC-registered investment adviser. Prior to Bitwise, she advised innovative financial technology companies at the law firms Wilson Sonsini Goodrich and Rosati and Troutman Pepper Hamilton Sanders. A graduate of Duke Law School and Duke University, and a member of Phi Beta Kappa, Collins-Wood began her career at Davis Polk & Wardwell, where she was a member of the capital markets group.

Dean Conway, shareholder of Carlton Fields, is a seasoned regulatory and trial lawyer with more than two decades of experience in complex securities enforcement, litigation, and regulatory compliance. While serving as an assistant chief litigation counsel at the SEC, Conway first-chaired all aspects of high-profile enforcement actions that encompassed the entire scope of the Division of Enforcement’s program, including public company disclosure, accounting and internal controls violations, investment advisers, broker-dealers, insider trading, and cybersecurity. He also advised on investigative strategy, charging decisions, and litigation risk, including providing pre-filing guidance to the SEC’s Asset Management Unit. Conway additionally advised on enforcement matters and regulatory policy while serving as counsel to an SEC commissioner.

Sara P. Crovitz is a partner at Stradley Ronon Stevens & Young, LLP. As a former deputy chief counsel and associate director of the SEC’s Division of Investment Management, Crovitz has over 25 years of experience providing guidance under the Investment Company Act of 1940 and Investment Advisers Act of 1940 to the asset management industry and to other domestic and foreign regulators. As co-chair of Stradley’s nationally recognized investment management practice, Crovitz provides counsel on independent trustees, registered funds and investment advisers. She also counsels funds and advisers in connection with SEC compliance examinations, SEC rulemaking comment letters, and seeking SEC exemptive, interpretive and no-action guidance. Crovitz earned her B.A. from the University of Chicago and her J.D. from the University of Chicago Law School.

Mederic (“Med”) Daigneault is senior vice president of regulatory services at Comply, where he leads partnership consulting, regulatory operations, and education, drawing on more than 20 years of consulting, legal, and leadership experience. A seasoned consultant, attorney, and thought leader, Daigneault has advised investment advisers on fiduciary obligations, Advisers Act compliance, and regulator-ready compliance program design. His background includes leading mock SEC examinations, drafting disclosures for hundreds of firms, and translating complex regulation into practical, business-aligned guidance. Previously, Daigneault was a shareholder in the Financial Services – Regulatory group at Carlton Fields and a compliance leader at National Regulatory Services. Daigneault is also a frequent industry speaker, and published author.

Brian Daly is director of the SEC Division of Investment Management. Previously, Daly worked at Akin Gump Strauss Hauer & Feld LLP in New York as a partner in the investment management practice; in the investment management group of Schulte Roth & Zabel LLP as a partner; at Kepos Capital as a founding equity partner and chief legal and compliance officer; and at Millennium Partners and Raptor Capital Management in general counsel and chief compliance officer positions. He also taught legal ethics at Yale Law School and served on the board of directors of the Managed Funds Association. Daly earned his law degree, with distinction, from Stanford Law School, his bachelor’s degree, magna cum laude and Phi Beta Kappa, from Catholic University, and his master’s degree from the East-West Center at the University of Hawaii.

Joshua Deringer is a partner at Faegre Drinker Biddle & Reath LLP. He has developed a strong client following for his skill in expanding liquid investment options and implementing innovative structures for private and alternative investment funds. Deringer‘s forward-thinking counsel has made him a sought-after attorney for national and international financial services companies involved in all aspects of the investment management industry. He has a reputation as one of the top attorneys and innovators in the rapidly growing nontraded closed-end fund space. Deringer also currently serves on the management board of the firm. He earned a B.A. from University of Pennsylvania and a J.D. from Fordham University School of Law.

Carlo di Florio is the president of ACA Group, where he leads global oversight of key businesses, client relationships, thought leadership, and strategic engagement with regulators, legislators, media, capital allocators, alliance partners, industry associations, and professional associations. Previously, di Florio worked for more than 25 years in executive leadership roles at PricewaterhouseCoopers (PwC), the SEC Office of Compliance Inspections and Examinations, and FINRA. He also serves on the Boards of several industry and professional associations and as an adjunct professor at Columbia University, where he teaches Strategic Risk Management in the Master of Science program in Enterprise Risk Management.

Michael Didiuk, a partner at Katten Muchin Rosenman LLP, draws on his extensive experience to advise financial institutions including private and registered funds, and investment advisers, on all aspects of their business, including structure, governance, compliance obligations under the federal securities laws, registered and private products, SEC examinations and investigations, and strategic transactions. He brings a wealth of knowledge and comprehensive understanding of the investment management space from his more than 20 years of experience at the SEC and in private practice. He also has deep and significant experience advising on the intersection of cryptocurrency and federal securities laws.

Jennifer A. Duggins, IACCP®, CRCP®, is a partner at Optima Partners. Before joining the firm in May 2025, she served as assistant director and co-head of the Private Funds Unit within the SEC’s Division of Examinations. Duggins is also an adjunct professor in Fordham Law School’s MSL Compliance Program, where she currently teaches Introduction to Corporate Compliance. Prior to joining the SEC, she was a director in regulatory risk consulting within the advisory practice of KPMG; senior vice president and CCO of Chilton Investment Company; and vice president, legal and compliance at Andor Capital Management. Duggins earned a B.A. in history from New York University and a M.S. in human resource management from Sacred Heart University John F. Welch College of Business.

Jennifer Eller is a principal in Groom Law Group’s Fiduciary and Retirement Services practice. She has been in practice for over 20 years advising financial institutions on retirement products and services and working closely with large corporate and public plan sponsors on ERISA compliance. Eller regularly attends fiduciary committee meetings and conducts fiduciary training. She holds a B.A., magna cum laude, from Avila College and a J.D., cum laude, from Georgetown University Law Center.

Langston Emerson is a partner at Mindset, a policy advisory and advocacy firm in Washington, DC. Emerson leads the asset management practice, where he advocates on federal policy issues important to clients and their investors and shareholders. He also leads a team to conduct due diligence on behalf of private equity and venture capital investments. Previously, he was the head of government affairs for the American Investment Council, advising large private equity firms, and led the financial service government affairs practice at TIAA during the creation of the Dodd Frank Act. Emerson holds a B.A. from Howard University, magna cum laude, and a J.D. from The George Washington University Law School.

Olivia Eori is a director in Kroll’s Financial Services Compliance and Regulation practice, based in New York. She leverages over 10 years of regulatory compliance experience in assisting investment advisers, including private equity, real estate and hedge fund advisers, in all phases of their business. At Kroll, Eori works closely with registered and exempted investment advisers to provide tailored compliance solutions, helping advisers navigate their obligations under applicable rules and regulations. She collaborates with advisers to thoughtfully implement industry best practices, conduct risk assessments for advisers’ businesses and compliance programs, and assist advisers during regulatory inquiries and examinations. Eori received a B.A., summa cum laude, from Fordham University.

Daniel Faigus, CAIA, CRCP, is the private funds specialist within the SEC Division of Examinations, a member of the SEC’s Private Funds Unit, and a co-coordinator of the SEC’s Private Funds Specialized Working Group. He works on complex examinations and investigations of private fund advisers both within the Division of Examinations and the Division of Enforcement. Faigus is also an adjunct professor at Georgetown University Law Center and Drexel University’s Thomas R. Kline School of Law, where he has developed courses related to private funds and the Investment Advisers Act of 1940. Previously, he worked at a big-four consulting firm assisting their private equity, hedge fund, and broker-dealer clients in navigating SEC and regulatory related matters. Faigus graduated from The George Washington University’s Honors Program with a degree in Finance and the Georgetown University Law Center’s Securities and Financial Regulatory Certificate Program.

Steven Farmer is the chief compliance officer for Confluence Investment Management LLC, responsible for managing the compliance program, which includes monitoring firm-wide compliance with internal policies as well as regulatory requirements. Before joining Confluence, he served as the chief compliance officer for Northern Trust Investments, Inc., 50 South Capital Advisors, LLC and various registered mutual funds. Previously, Farmer served as the chief compliance officer for Mesirow Advanced Strategies, Inc., as well as senior compliance positions for Mesirow Financial International in the U.K. and Hong Kong. He received a B.S. degree in Finance from Northern Illinois University and an MBA from DePaul University.

Bridget D. Farrell is associate general counsel at Edward Jones, where she leads regulatory policy. In her role advising on emerging policy developments, Farrell guides the firm’s advocacy and works to better inform the firm’s strategy and implementation efforts. Before joining Edward Jones, she was assistant general counsel at the Investment Company Institute. Previously, she served as senior counsel in the SEC Division of Investment Management and Division of Economic and Risk Analysis, working on initiatives ranging from standards of conduct to CCO liability. Farrell began her career at Morgan Stanley Investment Management, Linklaters LLP, and Gibson, Dunn & Crutcher LLP. She received her B.A. from the College of William & Mary and her J.D., cum laude, from the University of Pennsylvania Law School.

Richard Gabbert is chief of staff of the SEC’s Crypto Task Force. From January 2018 to January 2025, he was counsel to Commissioner Hester Peirce. Prior to joining the Commissioner’s office, he was a senior special counsel in the Office of Derivatives Policy in the Division of Trading and Markets at the SEC, where he focused on the implementation of derivatives market reforms required by Title VII of the Dodd-Frank Act. He has been involved extensively in several Title VII rulemakings, including rules further defining “security-based swap dealer” and “major security-based swap participant” and rules addressing the cross-border regulation of derivatives markets. Gabbert participated in the Mansfield Fellowship Program from 2016 to 2017, during which he was assigned to Japanese financial regulators, including the Financial Services Agency and the Bank of Japan.

Natasha Vij Greiner is chair of WilmerHale’s Investment Management practice. With more than two decades at the SEC, Greiner held senior roles across four agency divisions, most recently serving as director of the Division of Investment Management. where she led a team regulating the asset management industry and oversaw major policy and rulemaking initiatives. She previously served as acting co-director and deputy director of the Division of Examinations and national associate director of the Investment Adviser/Investment Company examination program, including the Private Funds Unit. She also served as acting chief counsel and assistant chief counsel in the Division of Trading and Markets and held positions within the Division of Enforcement—including the Asset Management Unit. Greiner earned a J.D. from The Catholic University of America, Columbus School of Law, and a B.S., cum laude, from James Madison University.

Laura L. Grossman is associate general counsel of the IAA. She has more than 20 years of experience as an investment management attorney. Prior to joining the IAA in 2012, she was in private practice for over 10 years in the New York office of Fulbright & Jaworski L.L.P. (now Norton Rose Fulbright), where she advised registered investment adviser, mutual fund and private fund clients on matters arising under the Investment Advisers Act, the Investment Company Act and other federal securities laws, the Commodity Exchange Act and associated regulations, and a wide range of compliance issues. Grossman received her B.A., summa cum laude, from Rutgers College, and she received her law degree from the University of Pennsylvania.

Andreana Guillet is a senior regulatory compliance consultant at CRC-Oyster, where she advises SEC-registered investment advisers and wealth management firms on regulatory matters and ongoing compliance responsibilities across diverse advisory models. She focuses on translating regulatory requirements into practical processes that foster a strong culture of compliance and promote scalability. Guillet began her career at the SEC’s Division of Examinations and later served as a securities examiner for Georgia and the District of Columbia. Before joining CRC-Oyster, she advised private fund advisers at RIA in a Box (now part of Comply). Guillet holds an MBA from the University of Maryland and a B.B.A. in Finance from the University of Georgia.

Vanessa L. Horton is the SEC’s national program director for its investment adviser/investment company examination program. She participates in multiple National Examination Program (NEP) and Commission-wide initiatives, including acting as a subject matter expert in the SEC’s National Exam Training program, co-chair of the SEC’s People Committee, and member of the EXAM’s Management Committee, and the Private Fund Special Working Group. Horton’s background is specifically in trading, operations, and compliance. Before joining the SEC, she spent more than 13 years in the private sector, most recently as the CCO of a dual registrant. She earned a B.S. from University of Illinois at Urbana-Champaign Gies School of Business and a master’s degree in strategic management from DePaul University.

Michelle L. Jacko, CSCP, is the managing partner and CEO of Jacko Law Group, PC, which offers securities, corporate, and regulatory compliance counsel and litigation services to investment advisers, broker-dealers, hedge and private funds, and financial industry professionals. She is also founder and CEO of Core Compliance & Legal Services, Inc. Jacko specializes in investment adviser, broker-dealer and fund regulatory compliance matters, mergers and acquisitions, regulatory examinations, internal control development, and operational risk management. Her practice focuses on complex matters involving regulatory and business risks, senior and retail client issues, cybersecurity and AI matters, Regulation S-P, policies and procedures, and regulatory examinations and enforcement matters. She received her J.D. from St. Mary’s University School of Law and B.A. from the University of San Diego.

Caroline Jankowski is a partner and the chief compliance officer for Operose. She joined the firm in 2019 and is responsible for administering the firm’s compliance program. Prior to joining Operose, she was a partner and project lead with Vista360, LLC. During her 11+ years at Vista360, Jankoski was responsible for assisting investment advisers and funds with SEC compliance and strategic matters, while also leading the firm’s research and consulting process efforts. Prior to joining Vista360, she was chief financial officer of Ziegler Capital Management and its proprietary fund family. Jankowski holds a B.A. in Economics and Spanish from the University of Wisconsin – Madison.

Casey J. Jennings is a partner in Seward & Kissel’s Investment Management Group and is located in Seward & Kissel’s Washington D.C. office. Jennings is a banking regulatory attorney specializing in advising non-bank financial institutions (such as investment managers, funds, broker-dealers, and fintechs) on banking and securities law issues, with areas of expertise in bank deposit funding, Bank Holding Company Act (“BHCA”) and Volcker Rule, data privacy and cybersecurity/incident response, FinTech regulation and licensing/blockchain, anti-money laundering, consumer financial protection and direct foreign investment (CFIUS).

John T. Jones is the financial services strategist at Egnyte, where he works with financial services firms navigating evolving regulations, data governance, and compliance-driven operational change. Before entering the software industry, he spent more than seven years in financial services at the intersection of IT, operations, and compliance, supporting regulated firms to ensure new technology aligned with regulatory requirements. Jones’ experience spans both the regulatory impact of policy changes and the realities of implementing compliant, scalable workflows. He holds a B.S. in Business Administration from Aquinas College and an MBA from Grand Valley State University.

Daniel S. Kahl is a partner in the Investment Funds Practice Group in the Washington, D.C., office of Kirkland & Ellis LLP. Kahl most recently served as acting director of the SEC Division of Examinations. He joined the exam program in 2016 as chief counsel and was later named deputy director. Formerly, Kahl was assistant director in charge of the Investment Adviser Regulation Office in the Division of Investment Management at the SEC. Prior to joining the Commission in 2001, he worked at the Investment Adviser Association, FINRA, and the North American Securities Administrators Association. He received his B.S. from Penn State University, J.D. from Southern Methodist University, and LL.M. (Securities) from Georgetown University.

Cynthia Kelly is managing director of compliance at ComplianceAdvisor, a division of STP Investment Services, where she advises investment advisers on the design, implementation, and ongoing management of comprehensive compliance, ethics, and risk programs. She brings more than two decades of experience supporting complex global financial services organizations across traditional and alternative investment strategies. Kelly most recently served as CCO of BennBridge US LLC and previously spent 15 years at Acadian Asset Management LLC, overseeing firmwide global compliance programs. She holds a Blockchain and Digital Assets Certification and advises on regulatory considerations for evolving strategies within existing securities law frameworks. Kelly also serves as a FINRA Non-Public Arbitrator.

Katie Klaben is a parter at Sidley Austin, where she advises a wide range of clients – including private fund advisers, public companies, executives, family offices, and broker-dealers – on securities regulatory, compliance, enforcement, and transactional matters. Katie works extensively with clients on their disclosure and reporting obligations under Sections 13 and 16, beneficial ownership determinations, and preventing and defending against short-swing profit liability. With a deep understanding of SEC rules and regulations governing beneficial ownership and an ability to translate complex regulatory requirements into clear, actionable guidance, Katie was recognized in Best Lawyers: Ones to Watch® in America for Securities Regulation (2026).

Jennifer L. Klass is a partner in K&L Gates’ New York office and a member of the firm’s Asset Management and Investment Funds Practice. She is an experienced financial services regulatory lawyer with deep expertise in investment adviser regulation and the convergence of investment advisory and brokerage services. Klass counsels clients on a wide range of securities regulatory matters, including fiduciary duty and conflicts of interest, disclosure and internal controls, advertising and marketing, SEC examination and enforcement actions, and M&A transactions involving regulated entities. She is a leading practitioner in digital investment advice and frequently assists clients in developing and offering innovative new services and incorporating emerging technology such as generative AI into their asset management business. Klass earned a B.A. from Lehigh University and a J.D. from Widener University School of Law.

Matt Knihtila is chief compliance officer for Capital Bank & Trust Company, Capital International, Inc., and Capital Group Private Client Services, Inc., and deputy chief compliance officer for Capital Research and Management Company, all part of Capital Group. He has 20 years of investment industry experience and has been with Capital Group for 16 years. He is a CFA Charterholder and has earned an MBA from the University of Minnesota’s Carlson School of Management and a bachelor’s degree in business administration from the University of Wisconsin-Eau Claire.

Matthew Kolesky is president and chief compliance officer for Arbor Capital Management, Inc. In 2020, Kolesky and the team at Arbor Capital launched Arbor Digital, an SMA offering focused on digital assets. As CCO for Arbor Capital, he sits at the intersection of compliance, traditional finance, and digital assets. Kolesky first interacted with Bitcoin by mining on his home computer in 2010, and later explored Ethereum after it launched.

Sanjay Lamba is associate general counsel at the IAA. Prior to joining the IAA, Lamba worked at SEC headquarters for 10 years, beginning his service in the rulemaking office of the Division of Investment Management before transferring to the Office of Chief Counsel (Legal Branch) in the Office of Compliance Inspections and Examinations in 2010. Prior to the SEC, he was in private practice advising registered investment adviser and mutual fund clients on a wide range of matters arising under the federal securities laws. He received his B.S. degree in Finance from George Mason University and his law degree from Boston University.

Josh Levit is chief compliance officer for ISSM and Private Markets, Americas at Invesco. In this role, he is responsible for overseeing the compliance function for the North American Direct Real Estate team and strategies managed through Invesco Senior Secured Management, Inc., Invesco Private Capital, Inc. and WL Ross & Co. LLC. Prior to joining the Invesco, he served as assistant general counsel at VEREIT, Inc.; assistant general counsel, vice president at AR Capital, LLC/RCS Advisory Services, LLC.; and as counsel II at the Pennsylvania Securities Commission in its Division of Corporate Finance. Levit earned a B.A in History from Duke University and a J.D. from the Dickinson School of Law.

Jeremy McCamic is the director of policy management at Fairview. He oversees a team responsible for monitoring regulatory changes and helping RIAs navigate those changes. This work includes writing policies and procedures and developing training on new regulations and best practices. Previously, he served as a relationship manager within Fairview’s Compliance Administration group, partnering with RIAs to provide full compliance administration support including SEC examinations, regulatory filings, compliance testing, and annual reviews. Prior to joining Fairview, Jeremy practiced trust and estates law. He earned his B.A. from the University of North Carolina and his J.D. from the University of North Carolina School of Law.

Ted McCutcheon is founder of Securities Law Counsel, PLLC, where he counsels private fund advisers and wealth managers on Advisers Act and regulatory compliance matters. Before founding his law firm, Securities Law Counsel, McCutcheon served as Senior Trial Counsel at the SEC, and in-house as general counsel and chief compliance officer for three RIAs, and a CPO and CTA. He was an adjunct professor of SEC Enforcement Law at Florida International University College of Law, has lectured at the University of Miami on fiduciary duty, regulatory compliance, and other topics, and regularly speaks and writes about adviser law and compliance. A licensed attorney in New York and Florida, McCutcheon graduated from Brown University and Cornell Law School.

Christopher Mulligan is a partner in Weil’s Private Funds practice, based in Washington, D.C. He represents a wide range of asset managers, as well as middle-market and newly-formed advisers, on various regulatory issues. Mulligan acts as outside regulatory counsel to asset managers on SEC examinations and investigations, marketing rule compliance, fund formation, mock examinations, SEC registration, Form ADV, Form PF, code of ethics, custody issues, LPA compliance, annual reviews and strategic advice. Before joining Weil in 2024, he spent over a decade at the SEC, most recently as investment adviser/private funds senior advisor and co-coordinator of the SEC’s Private Funds Specialized Working Group. He earned his J.D. from Georgetown University.

William A. Nelson is associate general counsel and director of public policy at the IAA. Previously, he was assistant general counsel and public policy counsel at CFP Board and chief compliance officer for Mercer Advisors. He has also held roles as an attorney with both the U.S. Departments of Justice and Veterans Affairs. Nelson has served as an adjunct professor at the University of Denver Sturm College of Law and George Washington University Law School. He received his undergraduate degree from the University of Tulsa, his J.D. with Honors from the University of Tulsa College of Law, and his LL.M. from the George Washington University Law School.

Kristen Niebuhr is the chief operating officer and chief compliance officer, as well as a member of the Board of Directors, at ARS Investment Partners, LLC, a boutique New York City investment advisory firm serving both wealth management and institutional clients. She has been immersed in the financial services industry since 1987, initially in compliance, administrative, and production roles at Merrill Lynch and Smith Barney. Over the last 30 years she has held various management and consultant positions at brokerage, advisory, and compliance consulting firms. Niebuhr holds a B.A. in Economics with a minor in Business Administration from Boston University.

Erik Olsen is chief compliance officer at Vident Asset Management. Prior to joining Vident, he served as a managing director at ACA Group as the head of registered investment company compliance. He also served was a compliance director at Legg Mason, where he headed the firm’s Global Compliance Examinations team, and as a securities compliance examiner in the SEC’s Office of Compliance Inspections and Examinations (Investment Adviser/Investment Company). Before the SEC, Olsen worked in the Mutual Funds Legal and Accounting Departments of Deutsche Asset Management. He earned his B.B.A. degree in Finance from Loyola College (now Loyola University Maryland).

John O’Neill is a partner and general counsel of Yacktman Asset Management. He joined the firm in 2022 after working previously at ACA Compliance Group, Affiliated Managers Group, Inc., and Deloitte & Touche LLP. O’Neill also practiced litigation in Boston for several years. He received a B.A. in Economics from the College of the Holy Cross and a J.D. from Suffolk University Law School.

Ray Palacios is the director of compliance at MONTAG Wealth Management. Passionate about serving and protecting the investing public, he served as an associate principal compliance examiner and an examination manager at FINRA for 5 years and then as a securities compliance examiner at the SEC for over 9 years. In addition to his years of regulatory experience, he received a master‘s degree in Accounting from Florida Atlantic University, obtained his Certified Fraud Examiner (CFE) license in 2012, and obtained his Certified Information Systems Security Professional (CISSP) license in 2025.

Mike Pappacena is a partner at ACA Aponix, ACA Group’s cybersecurity and risk division, where he provides leadership for division initiatives, mentoring and guidance of staff, and vision for future planning and growth. He serves as a team leader in providing cybersecurity risk assessments, vendor due diligence, policy authoring, staff training, and product development. Prior to ACA, Pappacena served as a project manager for Jefferies LLC and worked on several compliance initiatives. He spent 15 years at Goldman Sachs as a vice president in the Technology division, where he managed development teams, as well as the Fundamental Equities and Alternative Investments technology in the GSAM division. He a bachelor degree in electrical engineering from the Pratt Institute and his MBA from Adelphi University.

Jason Patel is chief technology and AI officer at Salus GRC. Patel is a hands-on technology executive with nearly two decades of experience driving innovation in governance, risk, and compliance. He has built award-winning code of ethics and RegTech solutions and, as the former global head of RegTech products at ACA Group, led the launch and expansion of the firm’s technology platform. in his current role, he is developing Vela, an agent-enabled AI platform that helps services firms keep pace with rapid AI advances. He also leads AI research in predictive, time-series risk analytics, applying techniques such as Gramian Angular Fields and 3D convolutional neural networks to surface early risk signals and improve decision-making.

Reza Pishva is a managing director, general counsel, and chief compliance officer at Payden & Rygel, as well as a member of the broader group responsible for legal, regulatory and compliance issues for the firm and its global subsidiaries. Prior to joining Payden & Rygel, Pishva was a senior vice president and counsel at Wilshire Associates Incorporated. Before that, he spent 15 years with the law firm of Dechert LLP, where he specialized in the area of investment management representing investment companies and investment advisers. Pishva earned his J.D./MBA from American University Washington College of Law and his B.A. in Economics and Political Science from Northwestern University.

Jennifer Porter is a partner in Willkie’s Asset Management Department. Based in the firm’s Washington, D.C. office, she provides advice to asset managers, including registered investment advisers, mutual funds, ETFs, and private funds on a variety of legal, regulatory and compliance matters. Porter is a former Assistant Director in the Division of Investment Management at the U.S. Securities and Exchange Commission and also served in a variety of other roles at the SEC throughout her career, including as a senior policy advisor for two of the Division of Investment Management’s directors and a senior advisor for Chair Mary Jo White. She holds a B.A. from Middlebury College and a J.D. from University of Maryland School of Law.

Erin Preston is the chief compliance officer for Wedbush Securities, a full-service broker-dealer and registered investment adviser. She has also served as the firm’s anti-money laundering (AML) compliance officer and currently has oversight of the firm’s AML program. With over 17 years’ experience as a legal and compliance professional, Preston has held various senior level compliance roles on the sell-side and buy-side, responsible for transforming and enhancing compliance programs. She earned a B.A. in international relations and affairs from The Ohio State University and a J.D. from the Elisabeth Haub School of Law at Pace University.

George B. Raine is a partner at Ropes & Gray LLP in the asset management group. He is well-versed on the complex regulatory and transactional issues faced by participants in the investment management industry. His practice includes the representation of U.S. and non-U.S. investment advisers; open- and closed-end investment companies and their trustees; hedge funds and other private investment pools, including real estate investment trusts; and broker-dealers. He earned his B.A., summa cum laude, from Yale University, his L.LM. from Humboldt-Universität zu Berlin, magna cum laude, and his J.D. from Yale Law School.

Jason Roberts is the founder and CEO of Pension Resource Institute, a consulting firm that specializes in assisting financial institutions with ERISA and Department of Labor regulatory compliance and delivering training, technical expertise, and practice management resources designed to help firms better serve retirement investors. He is also the founder and managing partner of Fiduciary Law Center (f.k.a. Retirement Law Group), a law firm focused on providing actionable solutions to investment fiduciaries and plan sponsors. In 2021, he co-founded Group Plan Systems, an independent Pooled Plan Provider for a growing number of Pooled Employer Plans or PEPs. Prior to founding PRI and RLG in 2010 and 2011, respectively, Roberts was a partner and co-chair of the Financial Services Practice Group at a leading ERISA law firm and the head of the Investment Fiduciary practice for a national securities law firm. He has a B.S.B.A in Finance & Banking from the University of Missouri and J.D. from UCLA Law School.

Aliya Robinson is director of congressional affairs for T. Rowe Price, leading the Legislative and Regulatory Affairs team’s work on all retirement-related public policy issues, which includes highlighting emerging retirement and compensation issues, coordinating the company’s policy position, and engaging with industry associations, policymakers, and thought leaders. Robinson previously served at The ERISA Industry Committee and the U.S. Chamber of Commerce. In these roles, she advocated for retirement legislation and testified on retirement and compensation issues before Congress, the Department of Labor, and the Department of Treasury. Robinson earned a B.A. in Economics and African studies from Yale University and a JD and MLA in Taxation from New York University School of Law.

Dave Rouse is a principal and chief compliance officer at GW&K Investment Management, LLC, with responsibility for managing the firm’s compliance program and is involved with various firm-wide risk management efforts. He is a member of various operating committees at GW&&K including the Investment, Brokerage, Cybersecurity/Business Continuity & Disaster Recovery, ESG, Proxy Voting and Valuation Committees. Most recently, Rouse served as GW&K’s director of compliance and risk management. Prior to joining GW&K, he held various related roles at Wellington Management Company and Fidelity Investments. Rouse received a B.A. in Sociology from St. Lawrence University. He is a member of the Greater Boston Chamber of Commerce Financial Services Leadership Council and is active in investment management industry organizations.

Tarryn Larson Rozen is director of operations and chief compliance officer of Armbruster Capital Management. Rozen grew up in South Africa and earned a Bachelor of Social Sciences from the University of KwaZulu-Natal. After relocating to the U.S., she began her career working for a private equity firm and discovered her passion for compliance and operations, focusing on how organizations can run more efficiently while adhering to industry regulations. Rozen joined Armbruster Capital Management where she became a registered Investment Adviser Representative. Rozen is engaged in community service in the Rochester, New York region. In 2023, she was honored with the Woman of Excellence Award by the Rochester Business Journal.

Valerie Ruppel is the chief compliance officer of IMA Advisory Services, Inc. Previously, Ruppel was an attorney-advisor in the SEC Division of Examinations, where she conducted examinations of registered investment advisers for compliance with federal securities laws, rules, and regulations. She also served as head of U.S. regulatory consulting for Bovill, a UK based consulting firm, vice president and senior counsel at ALPS Fund Services, and counsel at Empower. She holds a B.A. in Philosophy from Pepperdine University and J.D. from the University of Denver – Sturm College of Law.

Robert Saperstein is senior managing director, the head of Guggenheim Investments Compliance, the chief compliance officer of Guggenheim Partners Investment Management, and senior regulatory counsel. He joined Guggenheim in 2012 and has over 30 years’ experience as a legal and compliance professional. Prior to Guggenheim, Saperstein was CCO and associate general counsel at Caxton Associates; vice president and associate general counsel at Goldman Sachs; and a managing director at Bear Stearns. He also served as an Enforcement Division branch chief of the SEC after beginning his career at Rosenman & Colin LLP. Saperstein was a board member and co-chair of the Regulatory Advisory Committee of the National Society of Compliance Professionals and holds FINRA Series 7, 8,14, and 24 licenses. He graduated from Tufts University and George Washington University Law School with honors.

Christine Ayako Schleppegrell, a partner at Morgan, Lewis & Bockius LLP, counsels asset managers on legal, regulatory, and compliance matters, focusing on advisers to private funds (private equity, hedge, venture capital, infrastructure, real estate, credit) and separately managed accounts. She spent several years in private practice and more recently served at the SEC, including as senior counsel in the Investment Adviser Regulation Office, Private Funds Branch, where she advised on policy matters and counseled staff of the Divisions of Enforcement and Examinations. Schleppegrell earned her J.D. from the University of Washington School of Law and her B.A. from Vassar College and Oxford University.

Corey Schuster is co-chief of the SEC Enforcement Division’s Asset Management Unit, a national specialized unit that focuses on misconduct by investment advisers, investment companies, and private funds. Schuster began at the SEC as a staff attorney in 2010 and became an assistant director in 2016. Prior to the SEC, he worked for the law firms of Schulte Roth & Zabel LLP and Dickstein Shapiro LLP, and he previously served as an adjunct professor of law at Georgetown University Law Center. He received his bachelor’s degree from the University of Michigan and his law degree from Vanderbilt University.

Jennifer Selliers is a director, senior consultant at Renaissance Regulatory Services. She brings over 20 years of successful experience, overseeing administration and compliance of diverse financial initiatives within small, medium and large organizations (private and public). Her areas of expertise include compliance program development, policies and procedures formation and risk and control assessments. Selliers holds a B.S. in Business Finance from the University of Phoenix and a Master of Public Service Management from Cumberland University, in addition to other professional designations. Selliers is a current, contributing member of the National Society of Compliance Professionals (NSCP) and an adjunct professor at Fordham Law, Program on Corporate Ethics and Compliance (PCEC).

Victor Siclari is the chief compliance officer for Great Gray Group, LLC and its subsidiaries: Great Gray Trust Company, LLC, and Retirement Plan Advisory Group, LLC. Siclari is responsible for leading Great Gray’s enterprise risk management and compliance program, and guiding product, marketing, and operational initiatives. In this role, he leverages and applies his decades of legal, regulatory, operational and compliance experience in investment management, fiduciary, and banking organizations and the SEC’s Investment Management division. Siclari holds an LL.M. in Securities Regulation with distinction from Georgetown University Law Center, a J.D. from the University at Buffalo Law School, and a B.A. from Hofstra University.

Tracy M. Soehle is associate general counsel at the IAA. Previously, she was managing director and senior counsel at Affiliated Managers Group, Inc. where she was responsible for overseeing AMG’s regulatory affairs and legal and compliance support of its global operations and Affiliates. Prior to joining AMG, Tracy was a senior compliance manager at State Street Global Advisors; regulatory compliance manager at Wellington Management Company LLP; and an attorney at the law firm Dechert LLP. She received a B.S. from Boston College and a J.D. from Tulane University Law School.

Jennifer Songer is a partner at Paul, Weiss, Rifkind, Wharton & Garrison LLP where she advises many of the industry’s largest asset managers on legal, regulatory and compliance matters. Prior to joining Paul, Weiss, Songer worked at the SEC, most recently as counsel to the chair on investment management-related issues. Before that, she served as branch chief of the Private Funds Branch in the SEC Division of Investment Management. In that role, she led several rulemaking initiatives and served as a key adviser on private fund-related projects across the SEC. Prior to joining the SEC, Songer was in private practice where she advised clients on the organization and operation of private funds. She earned a B.A. from the University of Pennsylvania and a J.D. from Boston College Law School.

Erika Subieta is director and corporate counsel at Charles Schwab & Co, providing counsel to the Advisor Services Business. Prior to joining Schwab, she served as vice president at NCS Regulatory Compliance (now part of ACA Group). She provides strategic and regulatory advice pursuant to the Securities Exchange Act of 1934, Investment Advisers Act of 1940, FINRA Rules, and other relevant regulations. Subieta has significant experience in investment adviser and broker-dealer formation matters, business transitions and acquisitions, FINRA membership proceedings, and financial analysis and reporting for securities firms. She has served as a guest lecturer both in the collegiate academic environment and at private sector compliance events.

Lindsay Topolosky is a regulatory counsel in the National Exam Program Office within the SEC’s Division of Examinations, where she provides legal analysis and procedural guidance to examination staff in the Investment Adviser and Investment Company program and serves as an internal liaison between SEC divisions and an external point of contact for other regulators. She previously held roles in the Division of Examinations Office of Chief Counsel and the Broker-Dealer and Exchange Program. She gained international regulatory experience while seconded to the Supervision Division of the Financial Conduct Authority, one of the UK’s main financial services regulatory bodies. Prior to joining the staff, Topolosky worked in counsel and examiner roles at FINRA and a large financial services firm. She received her B.A. from Miami University of Ohio, her J.D. from Case Western Reserve University School of Law, and a Securities and Financial Regulation certificate from Georgetown University Law Center. She is a member of the bar in New York and the District of Columbia.

Mark T. Uyeda is an SEC Commissioner. Previously, he served as senior advisor to Chairman Jay Clayton, senior advisor to Acting Chairman Michael S. Piwowar, counsel to Commissioner Paul S. Atkins, and in the Division of Investment Management. He most recently served on detail to the Senate Committee on Banking, Housing, and Urban Affairs as a securities counsel to the committee’s minority staff. Before the SEC, Uyeda was chief advisor to the California Corporations Commissioner and an attorney at K&L Gates and O’Melveny & Myers LLP. He holds a B.S. in business administration from Georgetown University and a J.D. with honors from the Duke University School of Law. Uyeda is the first Asian Pacific American to serve as a commissioner.

Cathy Vasilev is co-founder of and compliance advisor at Red Oak. With more than 25 years in the financial services industry, Vasilev is a seasoned compliance expert and leader. Since co-founding Red Oak in 2010, she has leveraged her extensive experience across independent broker-dealers, wire-house broker/dealers, and RIAs to provide tailored compliance and technology solutions focused on effective risk management. Her approach combines creativity and flexibility, helping clients navigate complex regulatory landscapes by aligning compliance with strategic business goals rather than simply adhering to restrictions. Under her guidance, clients achieve operational efficiency through compliant pathways that support their unique objectives. Vasilev holds a Master’s degree in Business Management and a Bachelor’s degree in Business/Finance and is an active member of the NSCP and IAdCA.

Patrick Vergara is the chief operating officer at Norm Ai. Before joining Norm Ai, he was the co-founder, head of product, and COO at Alkymi, a New York-based technology company delivering AI-powered enterprise automation solutions to leading financial services firms. Prior to Alkymi, Vergara was part of the founding team at Say Technologies, a regulatory technology company that developed a platform for broker-dealer compliance and is now part of Robinhood. Prior to starting his technology career, he worked as an attorney at Simpson Thacher & Bartlett LLP and other law firms and is a member of the New York Bar. He holds a law degree from Stanford University, as well as undergraduate and master’s degrees from Yale University.

Steven A. Yadegari is the founder and CEO of FiSolve, an outsourced provider of COO, general counsel, and CCO services. Yadegari has more than 20 years of experience in the industry, including senior roles with the SEC, large national law firms, and a leading money management firm. He is director of an Irish UCITS fund complex, a contributor to the SEC’s Asset Management subcommittee for Small Advisers and Funds, an adjunct professor of law at the Cardozo School of Law, and former president of the NY chapter of the Association for Conflict Resolution. He has also trained staff in the SEC’s Enforcement Division and presents at the SEC’s Chief Compliance Outreach programs.