This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Zeena Abdul-Rahman is a branch chief in the Investment Company Regulation Office in the SEC’s Division of Investment Management. In this role, she manages rulemaking teams focused on Investment Company Act regulations and provides advice on policy initiatives affecting the asset management industry. Abdul-Rahman was a key member of the team that developed the Commission’s May 2022 proposed rulemaking to enhance disclosures by certain investment advisers and investment companies about ESG investment practices. Before joining the Division in 2015, she was an associate in the Washington, D.C., office of Dechert LLP. She received a B.A. from the University of Tennessee and a J.D. from the George Washington University Law School.

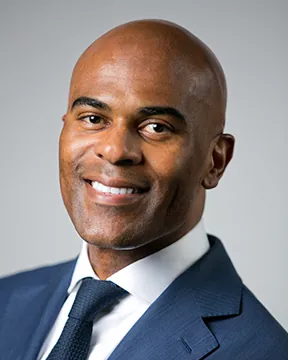

Adam S. Aderton is a partner in the Litigation Department at Willkie Farr & Gallagher and a member of the Securities Litigation & Enforcement Practice Group. His practice focuses on regulatory enforcement matters and white-collar defense. Aderton has particular experience in regulatory inquiries and litigation involving the asset management industry, including matters involving private equity funds, hedge funds, venture capital funds, mutual funds, ETFs, business development companies, and separately managed accounts. Before joining Willkie, he served in the SEC’s Division of Enforcement for over 14 years, including as co-chief of the Asset Management Unit. He received his undergraduate degree from Truman State University and his J.D. from the University of Virginia.

Matt Ahlstrand is a vice president of product management and solutions consulting for SS&C Advent. In this role, he is responsible for helping investment managers better understand, evaluate, and leverage technology. Ahlstrand’s product management responsibilities include steering the roadmap for the Advent Portfolio Exchange (APX), Revenue Center, and Data Solutions. He also leads the Americas-based Solutions Consulting team, whose depth of knowledge on industry and developing technology trends help drive client success. He joined the firm in 2002. Ahlstrand holds a B.A. in Spanish from the University of Colorado.

Karen Aspinall is a partner at Practus LLP and is the chair of the firm’s Financial Services practice area. With more than 20 years of in-house and AmLaw experience, Aspinall is an authority on regulatory compliance matters involving SEC, DOL, CFTC, and NFA regulations. Prior to joining Practus, Aspinall served as executive vice president and deputy general counsel for PIMCO. She also served as senior vice president for Nuveen Investments and was an associate at both Morgan Lewis & Bockius and Dechert.

Stephanie Avakian leads Wilmer Cutler Pickering Hale and Dorr LLP’s Securities and Financial Services Department in counseling and defending public companies, investment banks, asset management firms, accounting firms, boards of directors and individual executives through the challenges of government investigations. Prior to joining the firm, Avakian served as director of the SEC’s Enforcement Division. Matters under her direction concerned a wide range of issues including insider trading, financial fraud and disclosure violations, auditor and accounting issues, market structure, asset management, and the Foreign Corrupt Practices Act. Avakian earned a B.A., magna cum laude, from Trenton State College and a J.D., magna cum laude, from Temple University Beasley School of Law.

Davie Baccei is the chief compliance officer at Jordan Park. She is responsible for the firm’s compliance program, covering investment advisory, family office services, and an investment platform encompassing separately managed accounts and private funds. Prior to Jordan Park, she held numerous roles within compliance at Goldman Sachs for over 20 years, primarily covering private wealth management during a period of significant regulatory and business changes. She first joined Goldman Sachs in 1993 as an analyst and rejoined the firm in 1997 as an associate. She was promoted to vice president in 2000 and named managing director in 2014. Davie earned a B.A. in English Literature from the University of Tulsa.

Karen L. Barr is president and chief executive officer of the IAA. Before assuming the role of president and CEO in 2014, she served as the IAA’s general counsel for 17 years, with responsibility for the wide range of legal and regulatory matters affecting the investment adviser industry. Prior to joining the IAA, Barr was in private practice at Wilmer, Cutler & Pickering (now WilmerHale), where she represented clients in SEC investigations, securities class action litigation, internal corporate investigations, and securities regulatory matters. She received her B.A. from the University of Pennsylvania and her J.D. from the University of Michigan Law School.

David P. Bartels is a partner in Dechert’s financial services group. As former deputy chief counsel of the SEC Division of Investment Management, he has extensive experience with regulatory issues faced by asset managers and both registered and unregistered funds. He also managed guidance IM provided to the Divisions of Enforcement and Examinations and provided technical assistance on proposed legislation. Prior to joining the SEC, he was an associate in the corporate practice of an international law firm. He earned his B.A. from the State University of New York at Buffaloand his J.D. from Yale Law School. He is admitted to the Bar in the District of Columbia and New York.

Alison E. Baur is deputy general counsel and head of US legal at Franklin Templeton. Before joining Franklin in 2006, Baur was a vice president at Charles Schwab, serving as chief legal officer for Schwab’s Laudus Funds and Excelsior Funds and as a senior attorney supporting multiple business divisions. She started her career at the SEC, first as a law clerk for its Administrative Law Judges, then joining the Division of Investment Management as a senior counsel and then a branch chief. Baur is a graduate of UC Davis and UC College of the Law, San Francisco. She is chair of the IAA’s Board of Governors.

Bliss Bernal, IACCP®, is an executive director, shareholder, and the chief compliance officer of Crestone Asset Management, a multi-family office. Bernal serves as chair of the Crestone Risk Committee. Prior to joining Crestone, Bernal oversaw the daily operations of the compliance program at Manchester Capital Management. Before that, she served in compliance roles at two hedge funds in New York City. She began working in financial regulatory compliance in 2006. Bernal received her B.A. in international studies, with a concentration in East Asian studies, from Colby College. She also studied abroad at Stanford University’s (now Columbia University’s Global Engagement) Kyoto Consortium for Japanese studies in Kyoto, Japan.

Gail C. Bernstein is general counsel of the IAA. She joined the IAA in 2017 from the law firm of WilmerHale in Washington, DC, where she had been a special counsel and before that a partner in the Securities Department. While in private practice, Bernstein counseled clients on all aspects of financial and securities regulation. Bernstein earned her B.A. from the Hebrew University of Jerusalem and her law degree from Harvard Law School in 1988. After law school, Bernstein clerked for the Honorable Douglas P. Woodlock of the U.S. District Court for the District of Massachusetts.

William Birdthistle is the director of the SEC Division of Investment Management, where he leads the development of policy relating to investment advisers and investment companies. Before joining the SEC, Birdthistle was a professor at Chicago-Kent College of Law and, prior to that, an attorney at Ropes & Gray in Boston. He received his J.D. from Harvard Law School, his M.A. in History from the University of Chicago, and his B.A. from Duke University.

Monique S. Botkin is associate general counsel of the IAA. Prior to joining the IAA in 2004, she was an associate in the financial services groups at Dechert LLP in Newport Beach, California, and Alston & Bird LLP in Washington, DC. While in private practice, Botkin represented investment advisers, registered investment companies, private funds, and broker-dealers in corporate, securities and investment management matters. Botkin also served as an attorney in the SEC’s Division of Investment Management disclosure review office from 2013 to 2014. She earned her B.A. in government and politics from the University of Maryland at College Park and her J.D., cum laude, from Southwestern University School of Law in Los Angeles, where she was an editor of the Law Review.

Andrew J. Bowden is executive vice president and general counsel of TCW, responsible for leading all legal, compliance, and regulatory affairs for TCW globally. Before TCW, Bowden was chief operating officer of Western Asset Management Company. Previously, Bowden served as executive vice president, general counsel, and secretary with Jackson Financial, Inc.; director of the SEC Division of Examinations; and chief operating officer, general counsel, and executive director with Legg Mason Capital Management and deputy general counsel with Legg Mason, Inc. He began his career as a trial attorney in Baltimore. He holds a B.A., summa cum laude, from Loyola University and a J.D., cum laude, from the University of Pennsylvania Carey Law School.

Jason Brown is a partner in Ropes & Gray LLP’s asset management group and co-head of the firm’s private funds regulatory practice. He has extensive experience representing investment advisers to private equity funds, real estate funds, credit funds, venture capital funds, hedge funds, separate accounts, and commodity pools. Brown also assists private fund managers in registering as investment advisers with the SEC; advises clients on Advisers Act and other regulatory matters; and works with investment advisers on SEC examinations and enforcement actions. He received his J.D., cum laude, from Harvard Law School, and his B.A., summa cum laude, from the University of Pennsylvania, Wharton School.

Nevis Bregasi is senior vice president and deputy general counsel at MFS Investment Management, where she leads the Global Advisory Group. She joined MFS in September 2007 after working in the Bankruptcy and Commercial Law Department at WilmerHale’s Boston office and in the International Markets and Bankruptcy Departments at Allen & Overy’s New York office. She received her J.D. from Harvard Law School.

Ryan Burch is senior vice president, associate general counsel, and chief privacy officer at LPL Financial. In this role, Burch is responsible for leading the LPL Financial Privacy Office, which provides legal support for privacy, cybersecurity, and technology matters and advice on wide-ranging topics covering marketing, product development, incident management, data use, data subject rights, artificial intelligence, employee privacy, M&A, contract negotiations, regulatory, and government relations. Prior LPL Financial, he was vice president, legal – privacy, risk & cybersecurity at a global Fortune 500 fintech firm. Burch earned his B.S. and M.S. from Boston College, and his J.D. from University of Maryland Francis King Carey School of Law.

Maria Chambers, IACCP®, is chief compliance officer and vice president of Klingenstein Fields Advisors, where she oversees and administers the compliance program, including developing, implementing, and enforcing policies and procedures based on an assessment of applicable industry rules and regulations. Chambers began her career in the Corporate Legal Department at Cravath, Swaine & Moore. She then joined Morgan Stanley Investment Management Inc., where she oversaw the compliance program for the firm’s ultra-high-net-worth custom separately managed account and wrap account platforms. Most recently, she was a vice president and senior compliance officer at Guggenheim Partners Investment Management Inc. She graduated cum laude from Fordham University with a B.A. in Economics, a minor in Philosophy, and a certificate in Business Administration.

Charu A. Chandrasekhar is a litigation counsel based in Debevoise and Plimpton LLP’s New York office and a member of the firm’s White Collar & Regulatory Defense and Data Strategy & Security Groups. Her practice focuses on securities enforcement and government investigations defense and cybersecurity regulatory counseling and defense. Prior to joining the firm, Chandrasekhar served as an assistant regional director in the SEC’s Division of Enforcement and as the founding chief of the Division’s Retail Strategy Task Force. She also served as a senior advisor and senior counsel in the Division of Enforcement’s Market Abuse Unit.

Lewis Collins is a partner and general counsel for GW&K Investment Management, where he manages the firm’s legal, regulatory compliance, and risk matters and works to enhance the firm’s internal controls and business processes and contributes to new investment strategy launches and other business opportunities consistent with GW&K’s entrepreneurial culture. He is a member of various committees at GW&K including the Management, Investment, Diversity & Inclusion, Brokerage, Cybersecurity, and ESG Committees. Prior to joining GW&K, Collins worked for Affiliated Managers Group, Inc. (AMG), Ropes & Gray, and the Los Angeles Dodgers. He earned a B.A. from Williams College and J.D. from the University of Michigan Law School. He is a member of the Massachusetts Bar Association.

Sara P. Crovitz is a partner at Stradley Ronon, where she provides counsel on all aspects of investment adviser and investment company regulation, including the implementation of SEC regulation and guidance, strategy, and product development and responding to SEC compliance examinations. Previously, Crovitz was deputy chief counsel and associate director at the SEC, where she worked for 21 years, including 17 years in the Division of Investment Management focusing on issues under the Investment Advisers and Investment Company Acts of 1940. For many years, she also led the Division’s international efforts, including numerous IOSCO and FSB work streams. Crovitz earned her B.A. from the University of Chicago and her J.D. from the University of Chicago Law School.

Letti de Little is the chief compliance officer for Grain Management, LLC, a private equity firm that focuses on communications infrastructure and technology companies that connect the world to the information economy. She is responsible for overseeing legal, regulatory, and compliance matters for the firm. Additionally, she and her team lead the firm’s ESG initiatives. Prior to Grain, de Little was the chief compliance officer for Cartica Management, LLC. She also served as corporate counsel at Charles Schwab & Co. Inc. and corporate counsel at Partner Fund Management, LP. She earned her B.A. from the University of Virginia and her J.D. from Tulane Law School, and she is a member of the New York State Bar.

Jennifer Eller is a principal in Groom Law Group’s Fiduciary and Retirement Services practice. She has been in practice for over 20 years advising financial institutions on retirement products and services and working closely with large corporate and public plan sponsors on ERISA compliance. Eller regularly attends fiduciary committee meetings and conducts fiduciary training. She holds a B.A., magna cum laude, from Avila College and a J.D., cum laude, from Georgetown University Law Center.

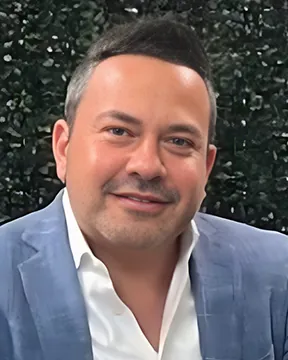

Langston Emerson is a managing partner at Mindset, a policy advisory and advocacy firm in Washington, DC. Emerson leads the asset management practice, where he advocates on federal policy issues important to clients and their investors and shareholders. He also leads a team to conduct due diligence on behalf of private equity and venture capital investments. Previously, he was the head of government affairs for the American Investment Council, advising large private equity firms, and led the financial service government affairs practice at TIAA during the creation of the Dodd Frank Act. Emerson holds a B.A. from Howard University and a J.D. from The George Washington University Law School.

Gordon Eng is general counsel and chief compliance officer of SKY Harbor Capital Management, LLC, an independent SEC-registered investment adviser with $4 billion in discretionary fixed income AUM in separately managed mandates, private and public collective investment structures in the US and EU. He holds a J.D. from Fordham University School of Law, an MBA from New York University Stern School of Business, and a B.S. in Economics from the Wharton School of the University of Pennsylvania. Eng is admitted to practice law in New York and Connecticut. Currently, Eng is enrolled in NYU-Tandon School of Engineering’s Chief Information Security Officer executive certificate program focusing on network security and threat intelligence/cybersecurity analytics.

Tori Erker, CIA®, is senior compliance monitoring and testing manager at Mercer Global Advisors, Inc., a position she assumed in January 2022. Since entering the securities industry in 2014, she has acquired experience in diverse roles encompassing sales, operations, supervision, and compliance consulting. Her expertise extends across broker-dealers, investment advisers, dually registered entities, and private funds. In her current role, Erker leads the monitoring and testing program, ensuring the completion of annual compliance reviews, risk assessments, and branch audits. She earned her Bachelor of Business Administration from Columbia Southern University.

Ranah Esmaili is a partner at Sidley Austin’s office in Washington, D.C., and a member of the firm’s global Securities Enforcement and Regulatory practice. She represents private fund managers, registered fund advisers and trustees, investment advisers to individuals, and broker-dealers in regulatory and government investigations and examinations. She also provides advice and counseling to clients on a wide range of securities regulatory matters. Previously, Esmaili served as assistant director of the SEC Enforcement Division Asset Management Unit and as counsel at a leading global law firm. She earned a B.A. from the University of Wisconsin, an M.A. from Johns Hopkins, and a J.D. from University of California, Berkeley School of Law.

Chad Estep is the chief compliance officer of Corient. Prior to joining Corient in 2023, he was the managing director, deputy CCO for Morgan Stanley Wealth Management, where he oversaw the compliance advisory functions for digital strategy, the private banking group, and international wealth management businesses. Estep joined Morgan Stanley following their acquisition of E*TRADE in 2020, where he served as enterprise CCO. Prior to joining E*TRADE in 2015, he served as the Enterprise CCO at Stifel and as an auditor with Deloitte. Estep graduated from Lipscomb University with a B.S. in Professional Accountancy.

Steven Farmer is the chief compliance officer for Confluence Investment Management LLC, responsible for managing the compliance program, which includes monitoring firm-wide compliance with internal policies as well as regulatory requirements. Before joining Confluence, he served as the chief compliance officer for Northern Trust Investments, Inc., 50 South Capital Advisors, LLC and various registered mutual funds. Previously, Farmer served as the chief compliance officer for Mesirow Advanced Strategies, Inc., as well as senior compliance positions for Mesirow Financial International in the U.K. and Hong Kong. He received a B.S. degree in Finance from Northern Illinois University and an MBA from DePaul University.

Adia Finn serves as senior manager, compliance and risk management at GW&K Investment Management, LLC. She is responsible for a broad range of areas under GW&K’s Compliance Program including assessing regulatory developments, disclosure requirements, and other supervisory obligations and risk considerations. Finn is also a member of various operating committees at GW&K and is co-chair of the ESG Committee. Prior to joining GW&K, she was a compliance manager at Affiliated Mangers Group, Inc. (AMG) and a manager at Deloitte & Touche. She received a B.A. in Government/Legal Studies & Romance Languages from Bowdoin College.

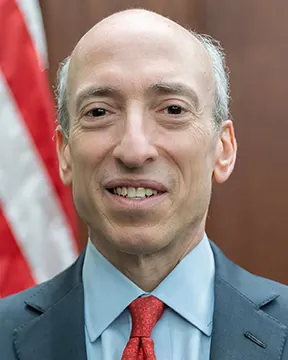

Gary Gensler is chair of the SEC. Before joining the SEC, Gensler was professor of the Practice of Global Economics and Management at the MIT Sloan School of Management, co-director of MIT’s Fintech@CSAIL, and senior advisor to the MIT Media Lab Digital Currency Initiative. From 2017–2019, he served as chair of the Maryland Financial Consumer Protection Commission. He also served as chair of the CFTC, as senior advisor to U.S. Senator Paul Sarbanes, and as undersecretary of the Treasury for Domestic Finance and assistant secretary of the Treasury. Prior to his public service, Gensler worked at Goldman Sachs. Gensler earned his undergraduate degree in economics and his MBA from The Wharton School, University of Pennsylvania.

Kelly L. Gibson is the co-leader of Morgan, Lewis & Bockius LLC’s securities enforcement practice and the firm’s ESG and sustainability advisory practice. She previously held numerous leadership roles at the SEC, including serving as the acting deputy director of the Division of Enforcement, as leader of the Enforcement Division’s nationwide Climate and ESG Task Force, and as director of the SEC’s Philadelphia Regional Office. Kelly advises and defends public companies, financial services clients, and their executives in SEC, self-regulatory organization (SRO), and state enforcement matters, and in internal investigations.

Christopher Gilkerson is president of RiAdvantage Consulting LLC and principal of Gilkerson Law, working on behalf of innovative wealth management firms, asset managers, WealthTechs, broker-dealers, and others in financial services transforming their business. Previously, he was SVP and chief legal officer at Charles Schwab & Co., where he headed the legal department responsible for multiple enterprises including retail, advisory, investment products, brokerage operations, digital, retirement, and international. He also served as assistant general counsel for market regulation at the SEC. Gilkerson received his B.A. in political science summa cum laude from The Ohio State University and his J.D. from Yale Law School.

Max Gokhman, CFA, is head of MosaiQ investment strategy at Franklin Templeton Investment Solutions, where he is responsible for defining the next generation of multi-asset investment processes. Previously, he was president and chief investment officer of the start-up asset manager AlphaTrAI, where he harnessed artificial intelligence to build alternative strategies for traditional and digital assets. Before that, he was head of asset allocation at the asset management arm of Pacific Life Insurance for seven years. Prior to Pacific Life, Gokhman was a portfolio manager with Mellon Capital’s multi-asset group and a founding member of Coefficient Global, a quantitative macro hedge fund. He earned a B.A. from Claremont McKenna College.

Katie Gorham is associate counsel at Capital Group, where she advises the enterprise on legal issues and transactions related to technology – including software-as-a-service (SaaS), technology outsourcing and generative artificial intelligence – data and technology governance, cybersecurity, and other information technology matters. Prior to joining Capital Group, Gorham worked at PricewaterhouseCoopers LLP (PwC) on complex technology and commercial transactions on behalf of PwC’s global network. Prior to PwC, she represented the buy-side and sell-side at Citadel LLC, where she created, implemented and oversaw enterprise policies and transactions related to Citadel’s procurement of data from alternative data sources. Gorham received her J.D. from Northwestern University Pritzker School of Law, her M.A. from Johns Hopkins School of Advanced International Studies, and her B.A. from Spelman College.

Laura L. Grossman is associate general counsel of the IAA. She has more than 20 years of experience as an investment management attorney. Prior to joining the IAA in 2012, she was in private practice for over 10 years in the New York office of Fulbright & Jaworski L.L.P. (now Norton Rose Fulbright), where she advised registered investment adviser, mutual fund and private fund clients on matters arising under the Investment Advisers Act, the Investment Company Act and other federal securities laws, the Commodity Exchange Act and associated regulations, and a wide range of compliance issues. Grossman received her B.A., summa cum laude, from Rutgers College, and she received her law degree from the University of Pennsylvania.

Patrick Hayes serves as chair of Calfee’s Investment Management practice and represents and supports investment advisers in the development and administration of their compliance programs, including the creation and implementation of policies and procedures governing all activities of the adviser. His clients include wealth managers, private fund advisers, family offices, ERISA investment fiduciaries, dual registrants, broker-dealers, cryptotraders, mutual fund trusts, and institutional asset managers. In 2020, Hayes launched The Securities Compliance Podcast: Compliance in Context™. Hayes earned a B.A., magna cum laude, from the University of Notre Dame, and a J.D. from the University of Cincinnati College of Law. He carries both Series 7 and Series 24 securities licenses and is licensed to practice law in the state of Ohio and the Commonwealth of Kentucky.

Michelle L. Jacko, CSCP, is the managing partner and CEO of Jacko Law Group, PC, which offers securities, corporate, real estate and employment law counsel to broker-dealers, IAs, investment companies, hedge/private funds and financial industry professionals. She is also founder and CEO of Core Compliance & Legal Services, Inc. Jacko specializes in investment adviser, broker-dealer and fund regulatory compliance matters, internal control development, regulatory examinations, transition services, and operational risk management. Her consultation practice focuses on regulatory exams/formal inquiries, mergers/acquisitions, annual reviews, policies/procedures development, testing of compliance programs, mock exams, and more. She received her J.D. from St. Mary’s University School of Law and B.A. from the University of San Diego.

Caroline Jankowski is a partner and the chief compliance officer for Operose Advisors. She joined the firm in 2019 and has 22 years of experience in the industry. She is responsible for administering the firm’s compliance program, as well as overseeing the day-to-day business management of the firm. Prior to joining Operose, she was a partner and project lead with Vista360, LLC where she was responsible for assisting investment advisers and funds with SEC compliance and strategic matters and leading the firm’s research and consulting process efforts. Before Vista360, she was chief financial officer of Ziegler Capital Management and its proprietary fund family. Jankowski holds a B.A. in Economics and Spanish from the University of Wisconsin – Madison.

Steve Johnson is a managing director and chief counsel for Schwab’s Wealth & Asset Management Legal team, which provides legal support for Schwab’s Retail advisory programs, Schwab’s custody business for independent advisers, and Schwab Asset Management. Johnson is an experienced lawyer with deep knowledge of the legal issues and business challenges faced in running a financial services business. He is a graduate of Spring Hill College and the University of North Carolina at Chapel Hill School of Law.

Ken C. Joseph is managing director and head of the Financial Services Compliance and Regulation practice for the Americas at Kroll, LLC, advising a variety of regulated persons and entities on their compliance and regulatory obligations in examinations and enforcement matters. Joseph previously served the SEC for 21 years, including as inaugural supervisor in the Division of Enforcement Asset Management Unit and most recently as a senior officer in the Division of Examinations. Joseph earned his B.S. and MBA in Marketing Management and International Finance from St. John’s University and his J.D. from the University of North Carolina at Chapel Hill School of Law.

Christian Kelly, CISSP, is the chief technology officer of Xantrion, an MSSP with a focus on technology and cybersecurity services for RIAs and financial firms. Kelly has 22 years of experience and has served as Xantrion’s CTO for the past eight years. In this role, he leads the teams responsible for ensuring the availability and security of client systems as well as conformance to regulatory requirements. Prior to his appointment as CTO, Kelly was Xantrion’s director of technology, responsible for managing technology development, data center and cloud operations, and vendor management.

Jennifer L. Klass is a partner in K&L Gates’ New York office and a member of the firm’s Asset Management and Investment Funds Practice. She is an experienced financial services regulatory lawyer with a particular focus on investment adviser regulation and the convergence of investment advisory and brokerage services. Klass counsels clients on the full range of federal and state securities matters, including managing examination and enforcement matters, advertising and marketing, fiduciary duty and conflicts of interest, disclosure, and internal controls. She regularly advises clients on the interpretation of new rules and consideration of emerging regulatory issues such as digital engagement practices. Klass earned a B.A. from Lehigh University and a J.D. from Widener University School of Law.

Michael B. Koffler, a partner at Eversheds Sutherland (US) LLP, guides investment advisers, private funds, and broker-dealers in their compliance with federal and state securities laws and SRO rules. He advises asset managers on the full spectrum of their operations, steers firms through regulatory examinations and inspections and helps clients build compliant and practical compliance programs. In addition, he counsels financial institutions – including banks and insurance companies – on building and operating investment and retirement platforms. Koffler previously worked at the SEC in the Division of Investment Management, where he reviewed registration statements, no-action requests, exemptive applications, and proxy statements and answered interpretive questions concerning the Advisers Act and the Investment Company Act.

Rachel Kuo is a senior counsel in the Investment Company Regulation Office of the Rulemaking Office in the SEC’s Division of Investment Management, which is responsible for rulemaking activities under the Investment Company Act in the Division and provides advice on policy initiatives affecting the asset management industry. Prior to joining the SEC, Kuo worked at New York Life Insurance Company as chief compliance officer of the MainStay mutual funds and IndexIQ ETFs; as an associate general counsel at Legg Mason; and an associate in Willkie Farr and Gallagher’s asset management group. Sheearned her B.A. from Georgetown University and her J.D. from The George Washington University Law School.

Joe LaFemina is a director on the Managed Services Solutions Management team at SS&C Advent. In this role, he manages the strategy and business needs for the managed services solutions provided to asset and wealth management firms. Prior to his current role, he was a senior relationship manager on the Customer Success team, where he helped complex asset management clients maximize their investment in SS&C Advent’s suite of products and services. LaFemina joined SS&C Advent in 2015. He holds B.S. degrees in Marketing and Accounting from Syracuse University and an MBA from Babson College.

Sanjay Lamba is associate general counsel at the IAA. Prior to joining the IAA, Lamba worked at SEC headquarters for 10 years, beginning his service in the rulemaking office of the Division of Investment Management before transferring to the Office of Chief Counsel (Legal Branch) in the Office of Compliance Inspections and Examinations in 2010. Prior to the SEC, he was in private practice advising registered investment adviser and mutual fund clients on a wide range of matters arising under the federal securities laws. He received his B.S. degree in Finance from George Mason University and his law degree from Boston University.

Gretchen Lee is chief compliance officer of Clifford Swan Investment Counselors. Immediately before joining Clifford Swan, Lee managed Crown City Compliance, a compliance consultancy firm she founded in 2009. Previously, she was chief compliance officer at Gamble Jones Investment Counsel and an investment associate at Engemann Asset Management. She received her B.A. in Economics from Scripps College in 1992 and frequently volunteers for her alma mater. She particularly enjoyed helping develop curriculum for the college’s Financial Literacy Program.

Josh Levit is chief compliance officer for ISSM and Private Markets, Americas at Invesco. In this role, he is responsible for overseeing the compliance function for the North American Direct Real Estate team and strategies managed through Invesco Senior Secured Management, Inc., Invesco Private Capital, Inc. and WL Ross & Co. LLC. Prior to joining the Invesco, he served as assistant general counsel at VEREIT, Inc.; assistant general counsel, vice president at AR Capital, LLC/RCS Advisory Services, LLC.; and as counsel II at the Pennsylvania Securities Commission in its Division of Corporate Finance. Levit earned a B.A in History from Duke University and a J.D. from the Dickinson School of Law.

Joseph M. Mannon is a shareholder and co-chair of the Investment Services Group at Vedder Price. He focuses his practice on legal and compliance matters for investment advisers, mutual funds, closed-end funds, and unregistered vehicles such as hedge funds, hedge fund of funds and other investment entities. He has substantial experience in regulatory and compliance matters affecting investment advisers, including registration and marketing, such as compliance with Global Investment Performance Standards (GIPS), as well as in drafting compliance policies and procedures. Mannon also spends significant time counseling registered and unregistered investment company boards. He earned his B.A. from Michigan State University and his J.D. from Loyola University Chicago School of Law.

Sofia Martos is a partner in the Los Angeles office of Kirkland & Ellis LLP and member of the firm’s ESG & Impact Practice Group. Sofia’s practice focuses largely on social and governance issues. She leads Kirkland’s DEI strategic services, advising clients on emerging legal developments, risk assessments, and risk mitigation strategies related to DEI. She also counsels clients on ESG and DEI disclosures in sustainability reports, proxy statements and annual reports, which includes advising on regulatory requirements, international disclosure trends, and industry best practices. Her experience advising on governance matters includes assessments of ESG programs and disclosures, board and management governance counseling through presentations and trainings, and shareholder activism defense.

Katie McGinley serves as the chief compliance officer for Mitchell McLeod Pugh & Williams, where she also provides investment management and consulting services to both individuals and qualified retirement plans. Katie has been engaged in 40 Act compliance since 2004, and previously practiced law in the areas of commercial real estate development and financing. She earned a B.A. from the Williams School of Commerce at Washington and Lee University in 1997 and a J.D. from The University of Alabama School of Law in 2000. McGinley is a member of the State Bar of Georgia and the Alabama State Bar.

Michael W. McGrath is partner in Dechert’s financial services practice. He focuses on advising global asset managers in the formation and operation of investment funds, regulatory compliance, and securities and commodities law across a wide range of asset classes and fund structures. He has significant experience advising asset managers on regulatory and transactional matters and frequently works with investment advisers, broker-dealers, and commodity trading advisers on regulatory compliance, examinations, the development of novel investment products, and the implementation of strategic transactions. Previously, McGrath was a partner at K&L Gates LLP, as well as vice president and senior counsel with Allianz Global Investors. He received a J.D. from Duke University and an A.B. from Stanford University.

Ian J. McPheron is head of Legal-Americas and board member for Aviva Investors, overseeing the team responsible for all legal and corporate governance matters in the U.S. and Canada. He is also a member of the AI’s North American Executive Team and Global Legal Executive Leadership Team. Prior to joining Aviva Investors, he spent 14 years at Harris Associates serving in several senior capacities, including interim general counsel and deputy general counsel focused on mutual fund, global investment advisory, and governance issues. He has also held senior legal and compliance positions with Calamos Advisors and Morgan Stanley/Van Kampen Investments focusing on open-end and closed-end funds and institutional and high net worth accounts. McPheron also contributed to the treatise Regulation of Investment Companies by Lemke, Lins, and Smith.

Max Mejiborsky is vice president, consulting services and executive consultant at Comply. He joined NRS in September 2007 as a consultant for the Investment Adviser Services Department. In his current role, he provides comprehensive compliance solutions, advice, and education to a wide variety of investment advisers. Prior to joining NRS, Mejiborsky worked as a corporate attorney for the Boston law firm of Choate, Hall & Stewart. He earned a B.A., summa cum laude, in international relations and Eastern Europe studies from Tufts University and a J.D., cum laude, from Boston College Law School. Mejiborsky is licensed to practice law in Massachusetts.

Kathryn Mellinger is an assistant general counsel in the Global Privacy, IT, and Records department at Vanguard, where she is responsible for advising on privacy and IT issues, including matters related to GLBA, CCPA, and GDPR. Prior to joining Vanguard, she was in private practice at BakerHostetler and Lewis Brisbois, where she counseled financial services, healthcare, and retail clients on legal issues involving privacy, cybersecurity and incident response. Mellinger holds a J.D. from Villanova University and a B.A. in English from the University of Richmond.

Paul Miller is a partner in Seward & Kissel’s Investment Management Group, located in the firm’s Washington D.C. office. He advises on the full range of matters affecting registered advisers, including their formation, registration with the SEC under the Investment Advisers Act of 1940, participation in managed account and wrap programs, and ongoing regulatory reporting and compliance obligations. He has also authored or co-authored many articles covering issues confronted by registered advisers and their clients. Miller earned a B.S. from University of North Carolina at Chapel Hill, Kenan – Flagler Business School, and a J.D., cum laude, from Syracuse University College of Law.

A. Valerie Mirko is a partner at Armstrong Teasdale LLP and chairs the firm’s Securities Regulation and Litigation practice. She represents broker-dealers, investment advisers, and private fund advisers in SEC enforcement, examination, and regulatory matters. Her practice focuses on issues related to conflicts of interest, distribution channels and marketing, safeguards and custody, and cybersecurity. Previously, she served as a partner in the financial regulation and enforcement practice of a global law firm; advised broker-dealers and investment advisers in enforcement investigations at a Washington, D.C., law firm; held legal and compliance roles at Oppenheimer & Co. and Merrill Lynch (now Bank of America); and served as general counsel of NASAA. Mirko is a graduate of Wellesley College and George Washington University Law School.

Dan Mistler heads ACA’s ESG advisory and data business. In his career, he has designed and implemented ESG programs for public and private markets investors, specializing in ESG for alternatives. Mistler has spent time in the capital markets helping entrepreneurs raise funds from ESG and impact-interested investors, quantified environmental, and social impact in transactions; guided investors and companies in monetizing the environmental and social aspects of their businesses; and assisted asset managers in getting the most out of ESG reporting. Prior to his work at ACA, he led ESG services at multiple other global and boutique consulting firms, focusing on financial services and implementing ESG with assets across sectors.

Chris Mulligan has held a number of positions at the SEC. Currently, he is the investment adviser/private funds senior advisor in the SEC Division of Examinations, where he leads the Division’s efforts to train exam staff and implement new investment adviser rules. He has drafted numerous investment adviser Risk Alerts, including on private fund advisers. Mulligan also helps develop significant rulemakings impacting investment advisers, counsels examiners on legal issues and enforcement referrals, conducts exams, trains staff, and develops exam initiatives and priorities related to private fund advisers. Before joining the SEC, Mulligan was in private practice, counseling private equity advisers and institutional investors with respect to fund formation and regulatory issues. He earned his J.D. from Georgetown University.

Sean Murphy is senior vice president, chief compliance officer, and senior counsel in the Legal and Compliance Department at EIG, an energy and infrastructure focused private equity fund manager. Prior to joining EIG in 2019, Murphy was a vice president and counsel at BlackRock, where he advised various business groups on commercial, regulatory, compliance and transactional matters. Previously, he was an associate in the Financial Services Group at Dechert LLP in Washington, D.C., and London, where his practice focused on providing counsel to managers of registered and unregistered investment companies. Murphy received a B.S. in Government from the College of William and Mary and a J.D. from Georgetown University Law Center.

William A. Nelson is associate general counsel at the IAA. Previously, he was assistant general counsel and public policy counsel at CFP Board and chief compliance officer for Mercer Advisors. He has also held roles as an attorney with both the U.S. Departments of Justice and Veterans Affairs. Nelson has served as an adjunct professor at the University of Denver Sturm College of Law and George Washington University Law School. He received his undergraduate degree from the University of Tulsa, his J.D. with Honors from the University of Tulsa College of Law, and his LL.M. from the George Washington University Law School.

Naseem Nixon is vice president and associate counsel at Capital Research and Management Company, where she provides counsel and leadership on a range of areas including U.S. regulatory policy and engagement, compliance oversight of advisory activities and operations affecting retail and large institutional clients, and mutual fund governance. Prior to joining Capital Group, Nixon served as a senior policy advisor to the director of the Division of Investment Management at the SEC. Before serving at the SEC, she practiced law as an associate with Eversheds Sutherland. Nixon received her J.D. from Brigham Young University J. Reuben Clark Law School and her bachelor’s degree in Public Policy Studies from Duke University.

Erik Olsen is chief compliance officer at Vident Asset Management. Prior to joining Vident, he served as a managing director at ACA Group as the head of registered investment company compliance. He also served was a compliance director at Legg Mason, where he headed the firm’s Global Compliance Examinations team, and as a securities compliance examiner in the SEC’s Office of Compliance Inspections and Examinations (Investment Adviser/Investment Company). Before the SEC, Olsen worked in the Mutual Funds Legal and Accounting Departments of Deutsche Asset Management. He earned his B.B.A. degree in Finance from Loyola College (now Loyola University Maryland).

Dabney O’Riordan is a partner at Quinn Emanuel Urquhart & Sullivan, where she focuses on SEC examinations and litigation, as well as general investment adviser compliance and internal investigations. A 17-year SEC veteran, she was the longest-serving leader of the Asset Management Unit. In addition to overseeing investigations, O’Riordan worked on various initiatives, task forces, and SEC rules including the Share Class Selection Disclosure Initiative, the Climate and ESG Task Force, the Interpretation Regarding Standard of Conduct for Investment Advisers, the Marketing Rule, the Proposed Private Fund Adviser Rule, and the Proposed ESG Disclosure Rule for Investment Advisers and Investment Companies. She received her B.S in environmental science, magna cum laude, from Wellesley College and her J.D. from the UCLA School of Law.

Alpa Patel is a partner in the Investment Funds Regulatory Solutions Group of Kirkland & Ellis LLP, where she focuses on counseling U.S. and non-U.S. investment advisers regarding the complex regulatory framework in which they operate. Patel counsels some of the largest, most sophisticated asset management firms on issues related to the registration, structure, and operations of their advisory businesses and navigating complex SEC examinations and enforcement investigations. Previously, she was branch chief of the Private Funds Branch of the Investment Adviser Regulation Office in the SEC’s Division of Investment Management, where she was a key adviser on private fund-related projects and priorities.

Mari-Anne Pisarri is a partner with Pickard Djinis and Pisarri LLP. She specializes in regulatory issues pertaining to investment advisers, NRSROs, and service providers to the securities industry and frequently writes and speaks about these matters. Pisarri received her B.A. from St. Lawrence University, summa cum laude, and her J.D. from Cornell Law School, magna cum laude.

Reza Pishva is a director, general counsel, and chief compliance officer at Payden & Rygel, as well as a member of the broader group responsible for legal, regulatory and compliance issues for the firm and its global subsidiaries. Prior to joining Payden & Rygel, Pishva was a senior vice president and counsel at Wilshire Associates Incorporated. Before that, he spent 15 years with the law firm of Dechert LLP, where he specialized in the area of investment management representing investment companies and investment advisers. Pishva earned his J.D./MBA from American University Washington College of Law and his B.A. in Economics and Political Science from Northwestern University.

Mukya Porter is a principal of CIM Group, serving as chief compliance officer of the company and two affiliated companies, OCV Partners and OFS Capital Management. Prior to joining CIM, Porter served as a senior vice president of compliance at Oaktree Capital Management. Her experience also includes roles at Pacific Investment Management Company as vice president, compliance; ay Morgan Stanley Global Wealth Management as vice president, legal; and at Morgan Stanley Investment Management as vice president, compliance. Porter earned a B.S. degree in Biology from Howard University and a J.D. from the University of California, Berkeley School of Law.

Jacob (Jake) Prudhomme is financial services, advisory at KPMG US, where his practice focuses on financial market structure and technology. He has more than 15 years of experience providing strategic advice to start-ups, fintechs, and Tier 1 financial institutions, including traditional and crypto-native broker-dealers, ATSs, investment advisors, MSBs, and financial data and analytics providers. He has extensive change management experience, including design and implementation of replicable controls and processes across jurisdictions, including EMEA, APAC, and LATAM. A former securities and options principal and SEC senior counsel, Prudhomme has fluency with a multitude of financial products from equities to fixed income to derivatives.

Adam J. Reback is a partner at Optima Partners, a leading global regulatory compliance advisory firm, where he focuses on supporting the regulatory and compliance needs of hedge funds, private equity funds, registered investment advisers, broker-dealers, independent research providers, and other global financial institutions. Reback has 25 years of investment management industry experience including as partner & CCO of J. Goldman & Co., L.P. and CCO of John A. Levin & Co. He is a regular contributor to various investment industry periodicals and frequently speaks at numerous industry events and conferences on a wide variety of topics. Reback attended New York University and completed the FBI Citizens Academy.

Jennifer Reiche, IACCP®, is the chief compliance officer for Eventide Asset Management, LLC, responsible for managing the firm’s compliance program and leading the Compliance team. Prior to joining Eventide in May 2022, Reiche held compliance roles at Marsh McLennan and its affiliate, Mercer, most recently as chief compliance officer of Mercer Funds, Mercer Trust Company, and Mercer Investments LLC. Previously, she served as chief compliance officer for Century Capital Management and the Century Funds, in various compliance roles for Wellington Management and Foreside Compliance Services, and in mutual fund administration, custody, and accounting at Investors Bank & Trust. Reiche holds a B.A. in Economics from the University of New Hampshire and a Certificate in Accountancy from Bentley College.

Julia Reyes, CIPM, is a partner with ACA Performance Services, a division of ACA Group. She focuses on the regulatory impacts to the presentation of performance and investment advisers’ claims of GIPS compliance. She has management responsibility for over 50 client relationships and has over 15 years of experience in the financial services industry. Reyes oversees the Performance Divisions’ Performance Process Committee and serves on the Thought Leadership council providing content and topics of interest to performance and compliance professionals. She earned her B.S. in Accounting from Arizona State University.

Aliya Robinson is managing legal counsel, legislative and regulatory affairs for T. Rowe Price, leading the Legislative and Regulatory Affairs team’s work on all retirement-related public policy issues, which includes highlighting emerging retirement and compensation issues, coordinating the company’s policy position, and engaging with industry associations, policymakers, and thought leaders. Robinson previously served at The ERISA Industry Committee and the U.S. Chamber of Commerce. In these roles, she advocated for retirement legislation and testified on retirement and compensation issues before Congress, the Department of Labor, and the Department of Treasury. Robinson earned a B.A. in Economics and African studies from Yale University and a JD and MLA in Taxation from New York University School of Law.

Seth Rosenbloom is general counsel of Betterment, where he oversees Betterment’s legal and compliance teams. He is deeply involved in Betterment’s advocacy before regulators and policymakers. Prior to joining Betterment in 2015, Rosenbloom worked at Davis Polk, where he was responsible for a range of litigation and regulatory matters. He also previously served as a law clerk for a federal judge. Rosenbloom serves as co-chair of the IAA’s Digital Advisers Committee. Seth holds a J.D from Columbia University School of Law and a bachelor’s degree in Human Biology from Stanford. University.

Jyothi San Juan, CPA, CIA, CISA, is senior manager and co-head of compliance management for Segall Bryant & Hamill, responsible for directing the day-to-day activities of compliance personnel in implementing all aspects of the firm’s compliance policies and program. Previously, San Juan worked at Allstate Investment Management in the compliance department and at Allstate Insurance in the internal audit department working on financial, operational, and IT audits. She has a B.S. in Accounting from DeVry University and an M.S. in Information Systems from DePaul University. San Juan also holds the Series 7, 63, and 24 FINRA registrations.

Andrea Santoriello is an executive director and assistant general counsel at J.P. Morgan Asset Management (JPMAM). She serves as chief counsel for the JPMAM Private Equity Group and leads a team covering various JPMAM Alternatives lines of business across asset classes. She also advises JPMAM on legal and regulatory issues impacting private funds and registered investment advisers, among other matters. Previously, Santoriello was a senior associate at the law firm of Davis Polk & Wardwell LLP in the Investment Management Group. She received a B.A. in Political Science from the College of the Holy Cross, summa cum laude, and a J.D. from Harvard Law School, cum laude. She is the chair of the IAA’s Private Equity Fund Advisers Committee.

Robert Saperstein is senior managing director and chief compliance officer of Guggenheim Investments. He joined Guggenheim in 2012 and has over 30 years’ experience as a legal and compliance professional. Prior to Guggenheim, Saperstein was CCO and associate general counsel at Caxton Associates; vice president and associate general counsel at Goldman Sachs; and a managing director at Bear Stearns. He also served as an Enforcement Division branch chief of the SEC after beginning his career at Rosenman & Colin LLP. Saperstein is a board member and co-chair of the Regulatory Advisory Committee of the National Society of Compliance Professionals and holds FINRA Series 7, 8,14, and 24 licenses. He graduated from Tufts University and George Washington University Law School with honors.

Corey Schuster is co-chief of the SEC Enforcement Division’s Asset Management Unit, a national specialized unit that focuses on misconduct by investment advisers, investment companies, and private funds. Schuster began at the SEC as a staff attorney in 2010 and became an assistant director in 2016. Prior to the SEC, he worked for the law firms of Schulte Roth & Zabel LLP and Dickstein Shapiro LLP, and he previously served as an adjunct professor of law at Georgetown University Law Center. He received his bachelor’s degree from the University of Michigan and his law degree from Vanderbilt University.

Robert Shapiro is an assistant director in the Chief Counsel’s Office of the SEC’s Division of Investment Management, where he oversees the provision of guidance relating to the Investment Advisers Act and the Investment Company Act. Prior to serving in his current role, Shapiro has, at different times, served as a branch chief in both the IM Liaison Office and the Chief Counsel’s Office. He has also served as vice president, corporate counsel to Prudential and as an associate in the office of Ropes & Gray LLP. Shapiro earned his B.S. in Political Science and History from the University of Illinois at Urbana-Champaign, and his J.D. from the University of Virginia School of Law.

Mara Shreck is head of regulatory affairs for J.P. Morgan Asset & Wealth Management, where she is responsible for directing the firm’s advocacy strategy on emerging regulatory policies. Prior to J.P. Morgan, she was in the law department at the Investment Company Institute, where she led industry-wide regulatory policy and advocacy efforts on matters affecting asset managers. She also served as an associate at Ropes & Gray, where she provided counsel to mutual funds boards and represented clients in various litigation, arbitration, and government enforcement matters. Shreck is a graduate of the UC Berkeley School of Law, and received her undergraduate degree, summa cum laude, from the Princeton University School of Public and International Affairs.

Neil A. Simon is the IAA’s vice president, government relations. He has a leading role in the formulation and communication of the IAA’s views on legislative and regulatory issues and is responsible for advocacy before the U.S. Congress. Before joining the IAA, he was director of government relations for the Financial Planning Association and served as executive director of the National Franchise Council. Prior to that, he was counsel in the law firm of Hogan & Hartson LLP (now known as Hogan Lovells). He received his B.A. magna cum laude from Clark University, his J.D. from Georgetown University, and is a member of Phi Beta Kappa.

Danielle Nicholson Smith is vice president and managing legal counsel for U.S. communications and digital services at T. Rowe Price. She advises on the firm’s advisory services and mutual funds marketing, with a focus on digital marketing and social media. She worked extensively on the implementation of the SEC Marketing Rule and its application to the firm’s advisory communications. Most of her time in the industry has been spent on SEC adviser marketing and FINRA advertising rules regarding communications with the public. She is the co-chair of the IAA’s Digital Advisers Committee and serves on FINRA’s Public Communications Committee and the Advertising Rules Committee of the Investment Company Institute. Smith received her B.A. from Smith College and her J.D. from the University of Maryland King Carey School of Law.

Alejandro Staroselski is a director within the Internal Audit department of Prudential. He provides audit coverage to ensure adequate oversight of key regulatory compliance risks across domestic and international businesses. His experience includes assessing businesses’ compliance and risk monitoring programs, corporate governance, and internal controls. Previously, Staroselski worked as a senior compliance examiner within the Sales Practice group at FINRA and in international private banking covering Latin America, managing high net-worth customer relationships and investment portfolios. He holds a J.D. from the University of Buenos Aires Law School; a LL.M. in Banking, Corporate, and Finance Law from Fordham Law School; and an M.A. in Conflict Resolution and Mediation from Tel Aviv University.

James Thomas is a partner at Ropes & Gray and co-head of its registered funds practice. He works with investment advisers, registered investment companies, including exchange-traded funds, and their trustees, and hedge funds and other private investment vehicles on everything from regulatory, compliance, and governance issues to trading activities, investments, and mergers and acquisitions. He has significant experience advising clients on organizing and operating registered investment companies that employ alternative investment strategies, and has guided clients in the area of ESG and responsible investing. Thomas earned his A.B., summa cum laude, from Dartmouth College and his J.D., magna cum laude, from Harvard Law School.

Samuel Thomas is a senior counsel in the Investment Adviser Regulation Office of the SEC’s Division of Investment Management, responsible for rulemaking activities under the Investment Adviser Act in the Division and provides advice on policy initiatives affecting the asset management industry. Before joining the Division of Investment Management in 2018, he was a counsel in the SEC’s Division of Examinations as well as an analyst in FINRA’s Department of Market Regulation. He received his B.A. from Bates College and his J.D. from the Catholic University of America School of Law.

Kimberly Versace is chief compliance officer at National Real Estate Advisors, LLC, where she is responsible for implementing and overseeing all aspects of the firm’s compliance program. She has extensive experience advising SEC-registered investment advisers on regulatory and compliance matters. Previously, she served as chief compliance officer for an emerging markets hedge fund adviser and as lead consultant to a wide range of investment adviser clients for a leading regulatory consulting firm. She spent much of her career practicing law in the securities regulation practice of a boutique law firm, with a focus on investment adviser regulation and compliance. Versace holds a B.A. in Modern Language, Politics from Fairfield University and a J.D. from Fordham University School of Law.

Natasha Vij Greiner is the deputy director and national associate director for the Investment Adviser/Investment Company Examination Program, which includes the Private Funds Unit, and associate director of the Home Office IA/IC Examination Program within the SEC Division of Examinations. Prior to these roles, she was the acting chief counsel and an assistant chief counsel in the SEC’s Division of Trading and Markets’ Office of Chief Counsel, where she provided legal and policy advice on matters affecting various market participants and the overall operation of the securities markets. Before that, she worked in the SEC’s Division of Enforcement and the Office of Compliance Inspections and Examinations. Greiner earned a J.D. from The Catholic University of America, Columbus School of Law, and a B.S., cum laude, from James Madison University.

Karyn D. Vincent, CFA, CIPM, is senior head, global industry standards at CFA Institute and is also the GIPS Standards executive director. Previously, she was managing partner for client services at ACA Performance Services. Vincent founded Vincent Performance Services LLC, which subsequently merged with ACA. She also was the global practice leader for investment performance services at PricewaterhouseCoopers. Prior to joining CFA Institute in 2018, she was an active volunteer, serving on numerous GIPS standards committees. She co‐authored “Complying with the Global Investment Performance Standards (GIPS®)” with Bruce J. Feibel. Vincent holds a bachelor’s degree in accounting from the University of Massachusetts Dartmouth.

Kurt Wachholz, IACCP®, is a managing director at Bates Group LLC. He has more than 25 years of experience in the financial services industry working in and with a wide range of companies including banks, insurance companies, broker-dealers, and investment advisers. Over the course of his career, he has served as an owner, partner, chief technology officer, chief compliance officer, OSJ, operations manager, registered representative, insurance agent, investment adviser representative, and compliance consultant. Wachholz has been the director of two investment advisory industry compliance professional development programs and is an editor for two industry compliance publications. He has previously held FINRA Series 7, 66, SIE and 24 licenses.

Jamie Lynn Walter is a partner in the Investment Funds Regulatory group at Latham & Watkins LLP, where she focuses on advising investment managers and large financial institutions on a wide range of complex legal, regulatory, and compliance matters across the asset management industry. Walter has served as lead regulatory counsel to several of the world’s largest investment advisers and has successfully counseled clients through numerous complex SEC examinations and enforcement investigations. She previously served as senior counsel in the Private Funds Branch of the SEC’s Division of Investment Management.

Seth P. Waxman is a partner at WilmerHale who represents clients at the trial and appellate stages, in both federal and state courts. He has argued 87 cases in the United States Supreme Court and hundreds in state and lower federal courts. Waxman represented Harvard College in the trial, appeal, and Supreme Court review of SFFA v. President and Fellows of Harvard College. Prior to WilmerHale, he was solicitor general of the United States from 1997 to 2001. Waxman is a fellow of the American Academy of Arts and Sciences, the American College of Trial Lawyers, and the American Academy of Appellate Attorneys, and he serves on the Council of the American Law Institute. He is a graduate of Harvard College and the Yale Law School.

Steven A. Yadegari is the founder and CEO of FiSolve, an outsourced provider of COO, general counsel, and CCO services. Yadegari has more than 20 years of experience in the industry, including senior roles with the SEC, large national law firms, and a leading money management firm. He is director of an Irish UCITS fund complex, a contributor to the SEC’s Asset Management subcommittee for Small Advisers and Funds, an adjunct professor of law at the Cardozo School of Law, and former president of the NY chapter of the Association for Conflict Resolution. He has also trained staff in the SEC’s Enforcement Division and presents at the SEC’s Chief Compliance Outreach programs.

E.J. Yerzak, CISA, CISM, CRISC, is managing director at Salus GRC. He has over two decades of experience as a cybersecurity and regulatory compliance professional. Previously, he was director of cybersecurity services for Confluence Technologies, which acquired Compliance Solutions Strategies (CSS) where he served in the same role. Yerzak has authored numerous articles on emerging technology and regulatory issues published in journals and by third parties and is the author of two award-winning technothriller fiction novels. He earned a J.D., magna cum laude, from Quinnipiac University School of Law, an M.S. from Central Connecticut State University in Computer Information Technology/Computer Science, and a dual B.A. from Colgate University, magna cum laude, in English and Computer Science.

Zephram J. Yowell is a senior vice president and senior counsel in the legal and compliance department in the Newport Beach office of PIMCO, where he advises on matters relating to PIMCO’s U.S. institutional clients and U.S. regulatory interactions. Yowell joined PIMCO in 2009 as a legal specialist. He has 13 years of legal experience and holds an undergraduate degree and a J.D. from Chapman University. He is a member of the California bar.

Wei Zhao is the chief compliance officer and head of compliance at Fiera Capital Inc., where she manages and develops the firm’s compliance program. She has more than 15 years of experience in the compliance and risk function in the investment management industry, including as the chief compliance officer for Penn Mutual Asset Management, LLC, and Penn Series Funds, Inc.; with Aberdeen Asset Management, where she held positions heading up the investment compliance team and auditing function in the US; and at BlackRock as vice president of the Portfolio Compliance Group. She received a bachelor of economics degree from The Central University of Finance and Economic (Beijing) and MBA from the University of Delaware.